Apart from Software Development, I also have an interest in governance and finances. Therefore, last July, I was quite happy to attend my first Annual General Meeting (AGM), taking place in GUADEC in Riga. I was a bit surprised by the format, as I was expecting something closer to an assembly than to a presentation with a Q&A at the end. It was still interesting to witness, but I was even more shocked by the huge negative cash flow (difference between revenue and expenditures). With the numbers presented, the foundation had lost approximately 650 000 USD in the 2021 exercise, and 300 000 USD in the 2022 exercise. And nobody seemed worry about it. I would have expected that such difference would come consequence of a great investment aimed at improving the situation of the foundation long-term. However, nothing like that was part of the AGM. This left me thinking, and a bit worried about what was going on with the financials and organization of the foundation. After asking a member of the Board in private, and getting no satisfactory response, I started doing some investigations

Public information research

The GNOME Foundation (legally GNOME Foundation Inc) has the 501(c)3 status. It means it is tax exempt. As part of such status, the tax payments, economic status and whereabouts of the GNOME Foundation Inc are public. So I had some look at the tax filling declarations of the last years. These contain detailed information about income and expenses, net assets (e.g: money in bank accounts), retribution of the Board, Executive director, and key employees, amount of money spent on fulfilling the goals of the foundation, and lots of other things. Despite their wide goal, the tax fillings are not very hard to read, and it’s easy to learn how much money the foundation made or spent. Looking at the details, I found several worrying things, like the fact that revenue and expenses in the Annual Report presented in the AGM did not match those in the tax reports, that most expenses were aggregated in sections that required no explanation, or that there were some explanations for expenses required but missing. So I moved on to open a confidential issue in the Board Team in gitlab expressing my concerns.

The answer mostly covered an explanation of the big deficits in the previous year (that would have been great to have in the Annual Report), but was otherwise generally disappointing. Most of my concerns (all of which are detailed below) were answered with nicely-written variations of: “that’s a small problem, we are aware of it and working on it”, or “this is not common practice and you can find unrelated information in X place”. It has been 6 months, a new tax statement and annual report are available, but problems persist. So I am sharing publicly my concerns with several goals:

- Make these concerns available to the general GNOME community. Even though everything I am presenting comes from public sources, it is burdensome to research, and requires some level of experience with bureaucracy.

- Show my interest about the topic, as I plan to present myself to the Board of Directors in the next elections. My goal is to become part of the Finance Committee to help improve in the transparency and efficiency of accounting.

- Make the Board aware of my concerns (and hopefully show that others also share them), so things can be improved regardless of whether I get or don’t get elected for the board

Analysis of data and concerns

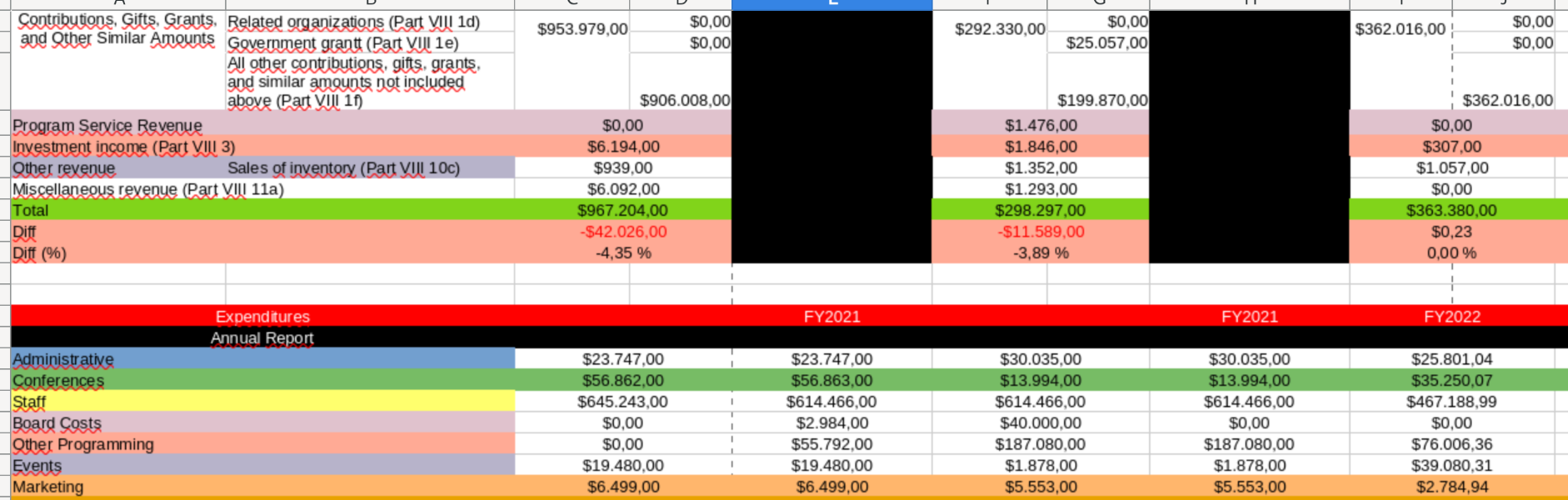

The first analysis I did some months ago was not very detailed, and quite manual. This time, I gather information in more detailed, and compiled it in an spread sheet that I made publicly available. All the numbers are taken from GNOME’s Annual Reports and from the Tax declarations available in Pro Publica. I am very happy to get those values reviewed, as there could always be mistakes. I am still fairly certain that small errors won’t change my concerns, since those are based on patterns and not on one-time problems. So to my concerns:

- Non-matching values between reports and taxes: in the last 3 years, for revenue and income, only the revenue in presented for Fiscal Year 2021/2022 matches what is actually declared. For the rest, differences vary, but go up to close to 9%. I was told that some difference is expected (as these numbers are crafted a bit earlier than taxes), the Board had worked on it, and the last year (the only one with at least revenue matching) is certainly better. But there are still something like 18 000 USD of mismatch in expenses. For me, this is a clear sign, that something is going wrong with the accounting of the foundation, even if improved in the last year.

- Non-matching values between reports from different years: each Annual Report contains not only the results for that year, but also from the previous one. However, numbers only match half of the time. This is still the case for the latest report in 2023, where suddenly 10 000 USD disappeared from 2022’s expenses, growing the difference from what was declared that year to 27 000 USD. This again shows accountability issues, as previous-years’ numbers should certainly not diverge even more from the tax declarations than initial numbers.

- Impossibility to match tax declarations and Annual Reports: the way the annual reports are presented, makes it impossible to get a more detailed picture of how are expenses and revenue split. For example, more than 99% of the revenue in 2023 is grouped under a single tax category, while the previous year at least 3 where used. However, the split in the Annual Reports remains roughly the same. So either the accounting is wrong in one of those years, or the split of expenses for the Annual Report was crafted from different data sources. Another example is how “Staff” makes the greatest expense until it ceases to exist in the latest report. However, staff-related expenses in the taxes do not make up for the “Staff” expense in the repots. The chances are that part of that is due to subcontracting, and thus counted in “Fees for services, Other” in the taxes. Unfortunately that category has its own issues.

- Missing information in the tax declaration: most remarkably, in the tax fillings of fiscal years 2020/2021 and 2021/2022, the category: “Fees for services, Other” represents more than 10% of the expense, which is clearly stated that it should be explained in a later part of the tax filling. However, it is not. I was told 6 months ago that might have to be with some problem with ProPublica not getting the data, and that they would try to fix it. But I was not provided with the information, and 6 months later the public tax fillings still have not been amended.

- Lack of transparency on expenses:

- First, in the last 2 tax fillings, more than 50% of expenses lay under “Other salaries and wages”, and “Fees for services, Other”. These fields do not provide enough transparency (maybe they would if the previous point was addressed), and means most of the expenses actually go unaccounted.

- Second, in the Annual Reports. For the previous 2 years, the biggest expenses were by far “Staff”. There exists a website with the staff and their roles, but there is no clear explanation of which money goes to whom or why. This can be a great problem if some part of the community does not feel supported in its affairs by the foundation. Compare for example with Mastodon’s Annual Report, where everybody on a pay-slip of free-lancing is accounted and written down how much they earn. This is made worse since the current year’s Annual Report has completely removed that category in favor of others. Tax fillings (once available) will, however, provide more context if proper explanations regarding “Fees for services, Other” is finally available.

- Different categories and reporting formats: the reporting format changed completely in 2021/2022 compared to previous years, and changed completely again this year. This is a severe issue for transparency, since continuously updating formats make it hard to compare between years (which as noted above, is useful!). One of course can understand that things need to be updated to improve things, but such drastic changes do not help with transparency.

There are certainly other small things that I noticed that caught my attention. However, I hope these examples are enough to get my point across. And there is no need to make this blog post even longer!

Conclusions

My main conclusion from the analysis is that the foundation accounting and decision-making regarding expenses has been sub-par in the last years. It is also a big issue that there is a huge lack in transparency regarding the economic status and decision-making of the foundation. I learned more about the economic status of the foundation by reading tax fillings than by reading Annual Reports. Unfortunately, opening an issue with the Board six months ago to share these concerns has not make it better. It could possibly be, that things are much better than they look from outside, but the lack of transparency is making it not appear as so. I hope that I can join the Finance Committee, and help address these issues in the short term!

Leave a Reply